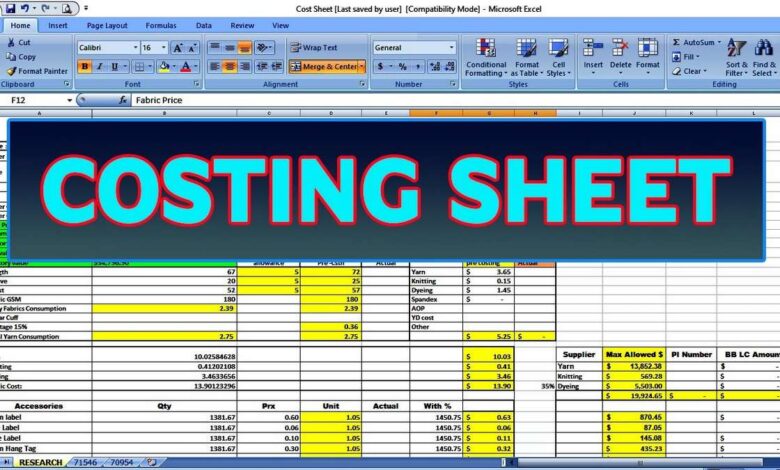

The purpose of creating the costing sheet is twofold. The prepared presentation is referred to as a costing sheet. As the second goal, you outline the basis for evaluating indirect costs. The costing sheet configuration extends the cost group function for displaying data and computing indirect costs. A costing sheet is a prepared presentation of data on the cost of goods sold for a manufactured item or a production order. When you build a costing sheet, you decide on the format of the information and the foundation for calculating indirect costs.

Here’s more information on the two goals of the pricing sheet setup:

Define the costing sheet’s format.

The user-defined format for a costing sheet indicates the cost segmentation that contains the cost of goods sold for a manufactured item. Based on cost groups, information regarding an item’s price of goods sold can be separated into the material, labor, and overhead. These cost groups are divided as per items, cost categories for routing processes, and algorithms for calculating indirect costs. When many cost groups have been identified, the costing sheet format often necessitates interim totals.

Define the methodology for estimating indirect expenses.

Manufacturing overhead connected with producing a produced item is reflected in indirect expenses. A formula for calculating indirect costs might be stated as a surcharge or a rate. A surcharge is a percentage amount of the value, whereas a rate is a fixed price per hour for a routing process. Suppose you want to construct a calculation formula and its cost group base. In that case, you must first identify the cost group representing the overhead and choose whether to use a surcharge or rate method in the costing sheet setup.

Each calculating formula must be recorded as a cost. A cost record includes a costing version, a surcharge % or rate amount, the cost group base, a status, and an effective date. When you activate a cost record, the status is changed to the currently active record, and the effective date is changed to the activation date. A site can also be specified in a site-specific calculation algorithm’s cost record. Alternatively, you can leave the Site box empty to indicate that the calculation methodology applies to the entire organization.

When the calculation formula is marked as a per-item formula, the cost record might optionally include a specified item or item group. Pending cost records are used in the future bill of materials computations. Two blocking policies for a costing version decide whether outstanding costs may be kept and if they can be started. Use blocking policies to allow data maintenance and then deny data maintenance for cost data in a costing version. After defining the costing sheet format and indirect cost calculations, you must complete a second step to validate and store the data.

The costing sheet is a company-wide method for consistently showing information about the costs of goods sold. The costing sheet appears on the Calculate item cost page. The costing sheet can be presented on the Item pricing page for a manufactured item’s calculated cost record or the BOM calculation results page for an order-specific calculation record. It can also be portrayed as part of a production order’s Price calculation page. Check what are mis reports.