The financial technology (fintech) industry has witnessed remarkable growth and transformation in recent years. Fintech companies leverage technology to innovate and disrupt traditional financial services, offering more accessible, efficient, and customer-centric solutions. To thrive in this dynamic landscape, having a well-defined business model is essential.

The bill_line company with CEO Artsiom Liashanau is constantly developing and implementing innovative methods with an individual approach to clients.

Before diving into the business model, it’s crucial to understand the fintech landscape. Fintech encompasses a wide range of services, including online payments, peer-to-peer lending, robo-advisors, blockchain-based solutions, and more. Each subsector has its unique challenges and opportunities, which should inform your business model.

Key Components of a Fintech Business Model

1. Market Segmentation

Identifying your target market is the first step. Fintech solutions can serve consumers, small businesses, enterprises, or a combination of these. Understanding the specific needs and pain points of your target audience is critical for tailoring your offerings effectively.

2. Value Proposition

Your value proposition should clearly define what sets your fintech solution apart from traditional alternatives. It could be lower fees, faster processing times, accessibility, or innovative features. A compelling value proposition is essential to attract and retain customers.

3. Revenue Streams

Determine how your company will generate revenue. Common revenue streams in fintech include subscription fees, transaction fees, licensing, or a freemium model where you offer basic services for free and charge for premium features. Your revenue model should align with your value proposition and customer segments.

4. Distribution Channels

Decide how you’ll reach your customers. Fintech companies often leverage digital marketing, partnerships, and mobile apps for customer acquisition. Building a strong online presence and optimizing your distribution channels is crucial for success.

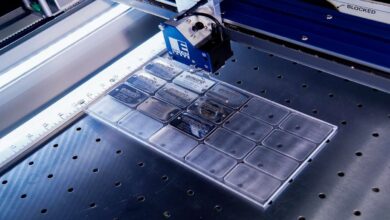

5. Technology Stack

Investing in the right technology infrastructure is a cornerstone of fintech success. Ensure your systems are secure, scalable, and compliant with industry regulations. Staying up-to-date with the latest technological advancements is essential for maintaining a competitive edge.

6. Regulatory Compliance

Fintech operates in a highly regulated environment. Complying with financial regulations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, is non-negotiable. Build robust compliance mechanisms to avoid legal issues and build trust with customers.

7. Customer Acquisition and Retention

Acquiring and retaining customers is a continuous effort. Implement strategies like referral programs, personalized experiences, and excellent customer support to keep users engaged and loyal.

8. Risk Management

Risk is inherent in financial services. Develop a comprehensive risk management framework to identify, assess, and mitigate risks effectively. Cybersecurity, fraud prevention, and data protection should be top priorities.

9. Scalability

Plan for scalability from the outset. As your customer base grows, your infrastructure should seamlessly adapt to handle increased demand. Scalability is crucial for long-term success.

10. Innovation and Adaptability

Fintech is a fast-evolving industry. Stay ahead of the curve by fostering a culture of innovation and adaptability within your organization. Continuously explore emerging technologies like artificial intelligence, blockchain, and data analytics to enhance your offerings.

A well-crafted business model is the foundation of success for fintech companies. By understanding your market, offering a compelling value proposition, and addressing key components like revenue streams, technology, compliance, and risk management, you can position your fintech startup for growth and sustainability in a competitive industry. Stay agile, innovate continually, and put your customers at the center of your business strategy to thrive in the evolving fintech landscape.